ACSI: Car Buyer Satisfaction Rises as Mass-Market Autos Challenge Luxury Brands

LEARN MORE: Affluent Car Buyers Are Surprisingly More Practical Than Indulgent

ANN ARBOR, Mich., Aug. 23, 2016 -- Car buyer satisfaction rebounds as domestic and mass-market brands improve, according to new data from the American Customer Satisfaction Index (ACSI). Customer satisfaction with automobiles is up 3.8 percent to 82 on ACSI's 100-point scale. Luxury cars have dominated the driver satisfaction rankings for years, but the top tier is now evenly split between mass market and luxury vehicles.

"The rise of mass-market vehicles may well be at the expense of luxury brands in the sense that buyers now see little differentiation between luxury cars and regular ones," says Claes Fornell, ACSI Chairman and founder. "If there is little difference, why pay more? Exclusivity may not be enough."

Among 24 auto brands tracked by the ACSI, 16 improve while 5 decline – 3 of which are premium brands. The most notable decline is for Volkswagen, which is embroiled in an emissions-cheating scandal that has angered customers, government officials, and consumer and environmental advocates. In a year dominated by improving customer satisfaction, Volkswagen drops 3 percent to 78, tied for lowest among mass-market vehicles.

"The combination of fines and fallen stock price are a big hit to Volkswagen's finances, but it may prove even harder to recover from the reputational hit the company will take for deceiving customers and the general public," says David VanAmburg, ACSI director. "Many customers or would-be customers could be turned-off of VW for life and it's hard to put a value on that."

All domestic automakers improve customer satisfaction overall this year, and the highest-scoring car is now an American brand. Ford's Lincoln takes the lead with a 5-percent jump to an ACSI score of 87. Honda claims second place with an 8-percent gain to 86, while Toyota and BMW each advance 4 percent, placing these luxury and mass-market brands in a tie for third place at 85.

Lexus, which previously held first place, is now matched by GMC (+8%), Subaru (+2%) and Nissan's Infiniti – the leading gainer with a 9-percent jump to 84. Audi (+6%) and Chevrolet (+5%) follow close behind at 83. The rest of the industry comes in below the industry average. The Ford brand edges up 3 percent to 81, catching up with Mercedes-Benz (-2%) and Hyundai (unchanged).

Nissan moves 4 percent higher to 80, matching Mazda (unchanged), while the Chrysler nameplate climbs 7 percent to meet Cadillac, Buick, Kia and Mitsubishi at 79. Acura loses ground, falling 8 percent to 76 at the bottom of the category.

"Year-to-date sales are looking pretty flat, and demand for cars may slacken some," says VanAmburg. "But the good news for Detroit is that higher levels of customer satisfaction will make it more competitive."

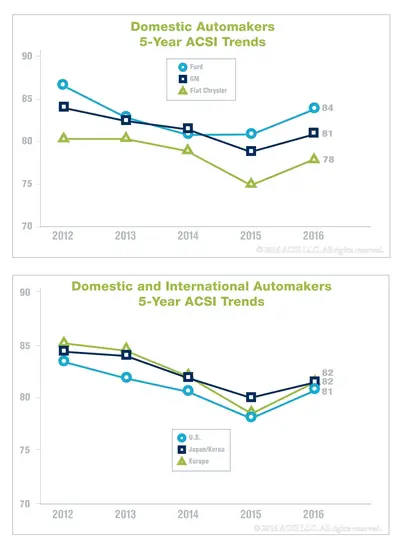

Among domestic automakers, Ford keeps its lead, stepping up to 84, followed by GM (81) and Fiat Chrysler (78). In comparison with foreign-made autos, which have long had the highest customer satisfaction, domestics are catching up, rising to 81 overall. European automakers also do better, matching Japanese and Korean manufacturers at 82.

The ACSI report, which is based on 3,776 customer surveys collected in the second quarter of 2016, is available for free download at http://www.theacsi.org/news-and-resources/customer-satisfaction-reports/reports-2016/acsi-automobile-report-2016.

Follow the ACSI on Twitter at @theACSI and Like us on Facebook.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About ACSI

The American Customer Satisfaction Index (ACSI) is a national economic indicator of customer evaluations of the quality of products and services available to household consumers in the United States. The ACSI uses data from interviews with roughly 70,000 customers annually as inputs to an econometric model for analyzing customer satisfaction with more than 300 companies in 43 industries and 10 economic sectors, including various services of federal and local government agencies.

ACSI results are released throughout the year, with all measures reported on a scale of 0 to 100. ACSI data have proven to be strongly related to a number of essential indicators of micro and macroeconomic performance. For example, firms with higher levels of customer satisfaction tend to have higher earnings and stock returns relative to competitors. Stock portfolios based on companies that show strong performance in ACSI deliver excess returns in up markets as well as down markets. At the macro level, customer satisfaction has been shown to be predictive of both consumer spending and GDP growth.

ACSI and its logo are Registered Marks of the University of Michigan, licensed worldwide exclusively to American Customer Satisfaction Index LLC with the right to sublicense.